PEOPLE PLACES TALK ABOUT TOWN Getting Mortgage Ready & New Mortgage Opportunities for Personal Wealth Building

New Port Richey, Florida

MEDIA RELEASE

MEDIA CONTACT:

Lia Gallegos, Public Relations Director, Residential Activation Coordinator

727.385.5375

People Places, LLC.

We Bring Out the Best in Both

5742 Main Street

New Port Richey, Florida

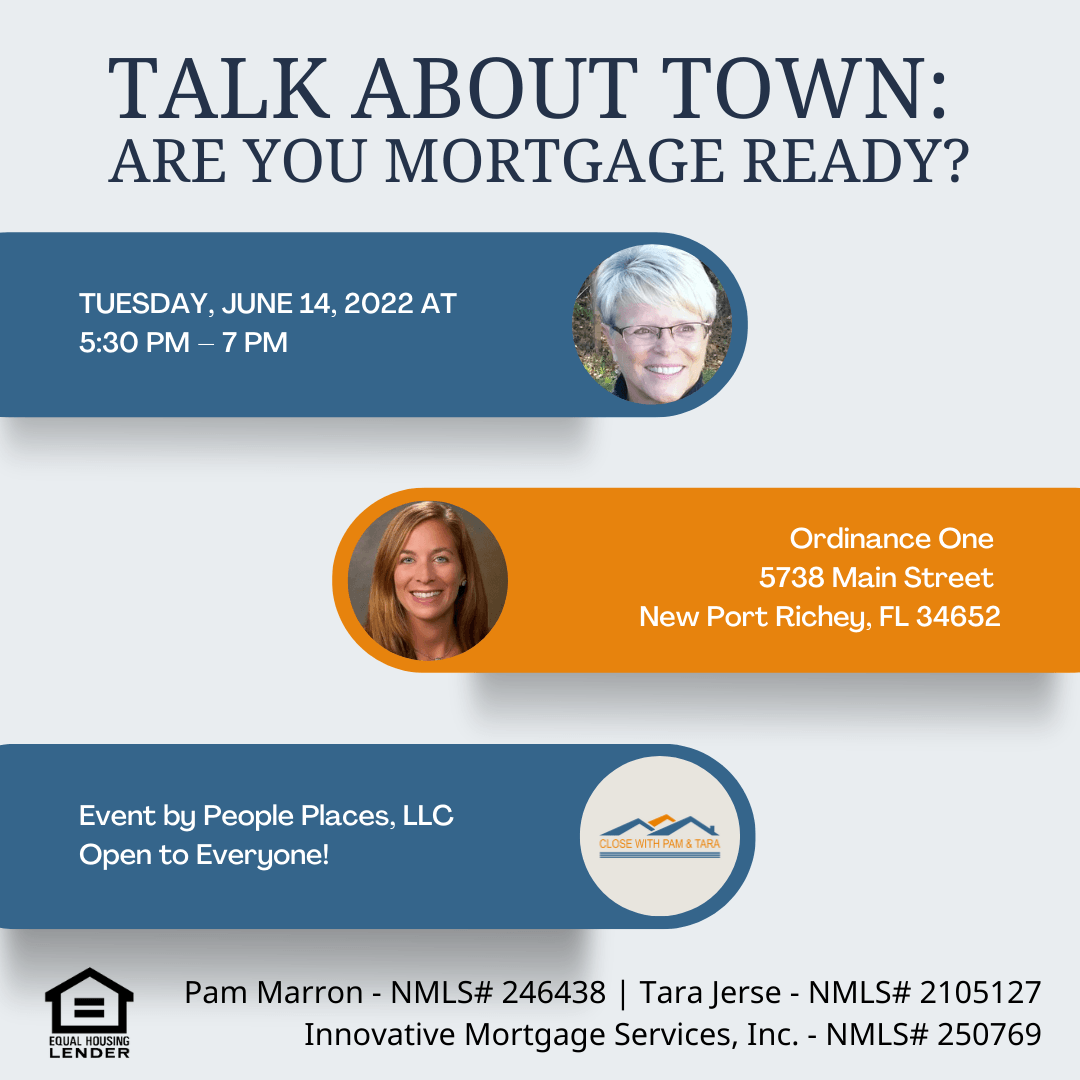

New Port Richey, Downtown, FL (May 24 , 2022) – Please join us for our next Talk About Town: Are You Mortgage Ready? on Tuesday, June 14, at Ordinance One (5738 Main Street, New Port Richey) from 6:00 pm to 7:00 pm with an opening Mingle at 5:30 pm. This event is open to the public and free to attend.

Many in our community are feeling the pain of soaring rent prices and are wondering if they will be able to continue living here–and if not here, where can they go that hasn’t also been affected? Pam Marron, a Florida licensed mortgage originator and former HUD Housing Counseling Federal Advisory Committee (HCFAC) member and her business partner Tara Jerse, also a licensed loan originator, will be presenting information on numerous new opportunities that make homeownership a real possibility for people who think they may not qualify.

These new home financing options include better mortgages for clients with income levels that are below the 80% median income for our area (under $58,160 annually), and for the first time ever, 95% financing for 2-4 unit properties that are owner-occupied. Additionally, a new program that can help anyone who is trying to get “mortgage ready” is being introduced and matches prospective homebuyers with issues that prevent home ownership to HUD housing and credit counselors who are trained to help clients become homeowners.

Attendees can expect to learn more about their community through this series from expert speakers and the exchange of ideas with the group during the discussion and Q&A session at the end of each gathering. For more information please, visit People-Places.com, and follow People Places LLC on Facebook or Instagram.

ABOUT PAM MARRON

As an independent, licensed mortgage originator for the last 37 years, Pam’s reputation is built on professionalism, integrity and the ability to keep transactions on track. In addition to assisting clients with FHA, VA, conventional, USDA, renovation and portfolio 1st mortgages, she is also uniquely qualified to provide specialized help with unique circumstances.

During the housing crisis, Pam worked with many government agencies and (past) U.S. Senator Bill Nelson (D-Fl) to get a fix for foreclosure credit code that was erroneously applied to the credit of past short sellers. Because of that work, Pam served as a member of the HUD Housing Counseling Federal Advisory Committee (HCFAC) from 2016 through 2019.During this time, Pam became aware of how HUD housing and credit counselors could assist clients to overcome issues that prevented them from purchasing a home. One of the results is a website called Clients2Homeowners.com that provides consumers, mortgage originators and realtors with direction for problem areas that often prevents prospective homebuyers from getting a mortgage.

Additionally, Pam Marron and Tara Jerse are working with a high-level tech company to develop a new platform that will connect clients who need help getting “mortgage ready” through their realtor or loan originator with appropriate HUD housing and credit counselors. If clients pay a fee upfront for help, the referring loan originator will provide a designated credit towards mortgage closing costs once the client is able to purchase a home. Pam and Tara chose New Port Richey to test the program before launching it nationally. For more information and additional resources, please visit: https://www.closewithpamandtara.com.

ABOUT PEOPLE PLACES, LLC

People Places is a New Urbanist Real Estate development company founded by Frank Starkey in 2013 to create vibrant, people-oriented residential and retail places in walkable settings.

We believe that a society of connected people is better than a society of separated individuals and actively seek projects that encourage cultural diversity, inclusion, and equity.

Our work is currently centered on the revitalization of Downtown New Port Richey, Florida, a charming town founded in the early 20th Century. We do this through education, the activation of public spaces, and projects that have the greatest potential to improve the community and create places for people to connect.

Frank Starkey holds undergraduate and professional degrees in Architecture and Urban Design from Rice University, is a board member for CNU (Congress for the New Urbanism) and Habitat for Humanity of Pinellas and West Pasco. He leads a team of passionate, dedicated professionals who are committed to community revitalization.

The People Places office is located at 5742 Main Street in historic downtown New Port Richey, Florida. Hours of operation are Tuesday through Thursday, 9:00 am to 5:00 pm.

Lia Gallegos

Public Relations Director/Residential Activation Coordinator

So, what do you need help with? Contact us Today!

Writer Pamela Marron is a licensed Loan Originator NMLS #246438 in Florida who works for Innovative Mortgage Services, NMLS #250769 in Lutz, Fl. Articles written are strictly her opinion and are published to help loan originators, real estate professionals and mortgage clients.