When Fannie Mae AUS Findings Require the Removal of a Dispute, Use CreditXpert What-If Simulator to Check on Credit Score After Deletion.

Credit repair companies often dispute accounts to improve credit scores. Sometimes those same disputes must be removed from the credit report to receive a Fannie Mae and Freddie Mac automated underwriting system (AUS) approval. Why? Because disputes hide credit. When the dispute is removed, negative credit may return. Check with CreditXpert and use their What-If Simulator tool to see if the removal of a Dispute will affect credit scores.

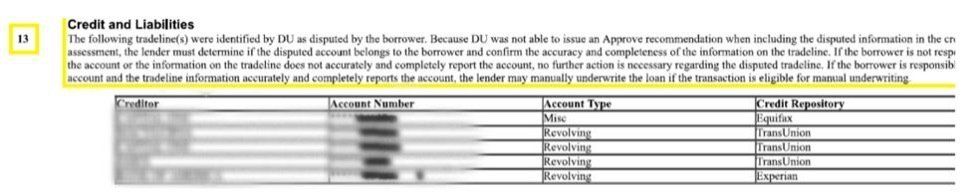

First, what Dispute notification in Fannie Mae Desktop Findings looks like.

Directions for deletion of Disputed Credit Report Tradelines per the Fannie Mae Selling Guide

The entirety of direction to follow for Disputes in the Fannie Mae Selling Guide for disputes on a credit report is below.

When the credit report contains tradelines disputed by the borrower, DU will first assess the risk of the loan casefile using all tradelines, including those disputed. If DU issues an Approve recommendation using the disputed tradelines, no further documentation or action is necessary. DU will issue a message specific to this scenario.

If DU does not issue an Approve recommendation when including the disputed tradelines, DU will re-assess the risk without using the disputed tradelines. If DU is then able to issue an Approve recommendation, the lender must investigate the tradelines to determine whether the borrower is responsible for the accounts or if the account information is accurate or complete.

- If the borrower is not responsible for the disputed accounts, the lender must obtain supporting documentation and may deliver the loan as a DU loan. No further action is necessary regarding the disputed tradelines.

- If the borrower is responsible for the disputed account, the lender must investigate the information, including determining the aspect of the tradeline that is being disputed. If the borrower is able to provide documentation to disprove any adverse information (such as canceled checks), the lender may deliver the loan as a DU loan.

- If the borrower is responsible for the disputed account and the account and tradeline information is accurate and complete, the loan is not eligible for delivery as a DU loan. The lender may manually underwrite the loan if the transaction is eligible for manual underwriting.

The monthly payments for the disputed tradelines must be included in the debt-to-income ratio if the accounts belong to the borrower.

Note: Tradelines reported as medical debt are not shown in the disputed tradeline message. Therefore, lenders are not required to investigate disputed medical tradelines.

Examples

The following scenarios are examples of when a loan receiving an Approve/Eligible recommendation with the disputed tradeline(s) excluded from DU's risk assessment would be eligible for delivery as a DU loan:

- A borrower’s account was referred for collection by the creditor. Subsequently, the borrower paid off the account, but the pay-off was not reported on the tradeline. The borrower requested that a dispute be placed on the tradeline. The tradeline information was accurate, but because it did not reflect that the borrower paid off the account, it may be considered incomplete. The borrower must provide documentation that the account was paid in full.

- A borrower and his son have the same name (Sr. and Jr.). The borrower’s credit report contains a tradeline that actually belongs to the son. The tradeline is reported as disputed. The borrower can provide confirmation that he is not obligated on the account.

- The servicer of a disputed loan indicates a late payment in January of the previous year. The borrower can provide documentation (such as canceled checks or bank statements) that indicate that the payment was made on time.

The following scenario is an example of when a loan receiving an Approve/Eligible recommendation with the disputed tradeline(s) excluded from DU’s risk assessment would not be eligible for delivery as a DU loan:

- The credit report indicates a disputed tradeline on the borrower’s mortgage being refinanced. The tradeline indicates a 60–day late payment in January of the previous year. The borrower cannot provide any documentation to support that the payment was made on time.

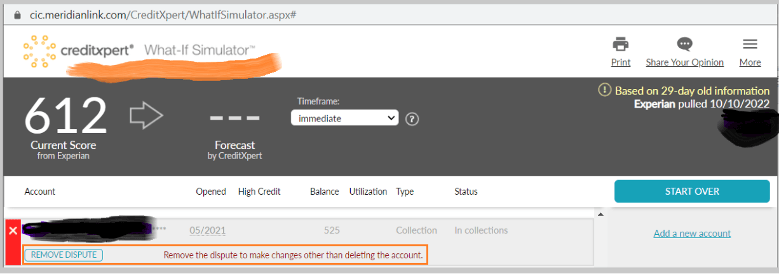

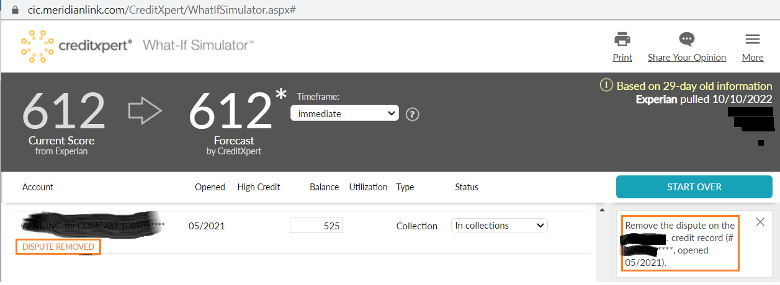

How to use CreditXpert What-If Simulator to check credit score if Dispute removal is done.

- How to check: Click on “REMOVE DISPUTE” button on CreditXpert What-If Simulator

To find out how the removal of a dispute will affect your clients credit score, check what removing the dispute will do to a credit score at all 3 bureaus with the

CreditXpert What-If Simulator available through your credit reporting agency.

Directions for client to follow are on the right. Note: Removing a Dispute does not always change the credit score.

What do you need help with? Contact us Today!

Pam Marron | NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc. | NMLS# 250769

Equal Housing Lender